WE WISH WE HAD BETTER NEWS...

Last year, we had the wonderful pleasure of showing improvements in 2023 in terms of overall industry workforce satisfaction and engagement. Unfortunately, what we are observe is that Q4 of 2024 and Q1 of 2025 are going to be rough time periods for workforce strategies.

Key Findings From This Edition of the CQI Report:

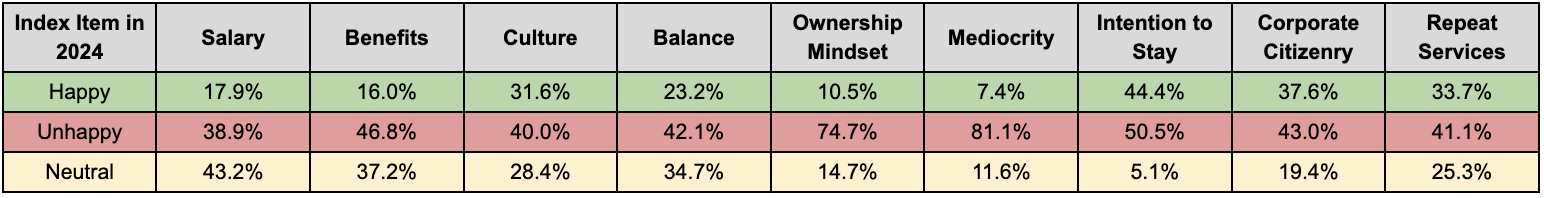

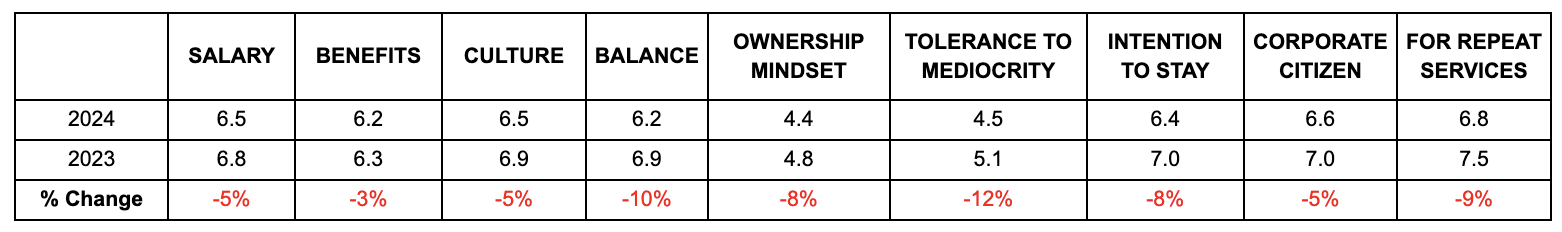

- Work Life Balance and Tolerance To Mediocrity fell by double digit percentages — the workforce is equally unhappy about colleagues and managers "allowed to coast on by" or "fly under the radar" as much as they feel the work has intruded upon their personal lives.

- The relationship between culture, and intention to stay and tolerance to mediocrity has strengthen significantly.

- There is an over 50% increase in how the workforce views their own Intention to Stay through how they view their ability to participate in Ownership Mindset AND how their employers manage Tolerance to Mediocrity.

- Workforce members prefer the absence of a negative rather than the presence of a positive — specifically: removal of micromanaging behaviors from direct supervisors.

- There is also a noted 8% drop in intention to stay. If 2023’s staffing challenges were bad, it’s about to be a lot worse as the majority of turnover and hiring crisis exists between the Fall and Winter months, each year.

- There is a dichotomy that is widening. If things are good at a company then they are great. If they are bad, then it's actually way worse than perceived by management.

- Employees who score 7-8 out of 10 for Intention to Stay are already casually open to new jobs.

- Employees who score less than 5 on Intention to Stay have been actively looking to get out.

- New predictive metrics have been established, suggesting that even if an organization's score doesn't change, should a weighted importance of key items begin to wane — it actually indicates that an organization’s workforce is beginning to disengage from the mission of the company.

Snapshot of the Respondent Pool and Global Scoring

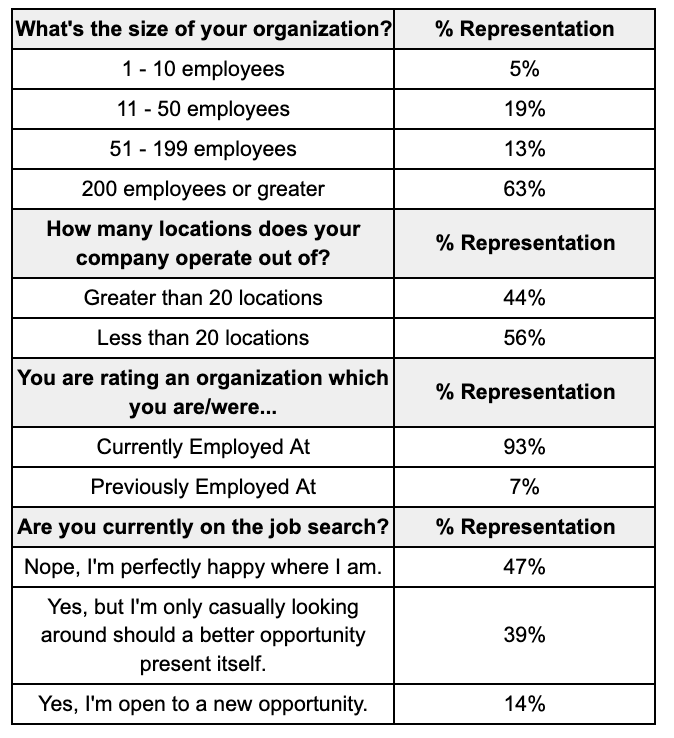

People Are Looking Around...

Typically, there is a Summer lull in terms of resignations and new hires. However, we've been getting more word — especially from small business private practices that they still need talent... and, they needed it last week.

By the numbers nearly 15% of the talent pool is looking for a new job; nearly 40% is casually open to change. This needs to be attended to as Fall and Winter months tend to host the largest turnover rates in the hiring cycle, followed by a Q1 hiring crisis.

2024 Has Been A Difficult Year

Every single index item showed decline compared to 2023. Moreover, there has become a true strain in the industry's workforce in terms of Ownership Mindset and being included in decision making discussions; and, in Tolerance to Mediocrity, where often things fly under the radar — or, where mediocrity is often rewarded secondary to a tenure or senior staff member simply being there that long.

Intention to Stay: Action vs. Inaction

Most will appreciate that the current national average for Intention to Stay isn't exactly high... sitting a 6.4 out of 10. This is actually a red flag threshold as anything 8 and under means that your employees are already beginning to look around for other options.

However, we are pleased to say that all organizations participating with UpDoc's workforce intelligence platform, HIYER™, are scoring an average of 9.45 out 10 — well safe within retention benchmarks; both due to an improve trust effect, but also because the associated variables that contribute to crisis are being attended to as revealed by the platform's easy to read analytics.

New Weighted Index Items Serve Both As Multipliers and Early Warnings Signs

This year's CQI presented two new index items as weighted importance items on micromanagement and on team first leadership behaviors. As mentioned above, the workforce generally prefers the absence of negative (micromanagement) rather than a presence of positive (team first, even if it makes the supervisor look bad).

We also noted early results in discussion as it pertains to HIYER™ participants by which should these weighted indices lower in any way, yet the remaining benchmarks demonstrate no change — what this actually shows is early disengagement of the staff from the mission of the company.